Using MasterDATACSV

Composite Breadth Data In Excel

Using MasterDATACSV

Composite Breadth Data In Excel

|

|

Once

downloaded, the most efficient way

to use our .csv composite datafiles

on a regular basis is to leave them

as is and to instead link them to

an Excel (.xls) spreadsheet.

With both the .csv datafile and

.xls spreadsheet opened from within

the same directory (open the .csv

file first then the .xls file),

each cell in the spreadsheet links

directly to a cell in the downloaded

.csv datafile.

This

.xls spreadsheet is where you will

do your calculations. On subsequent

downloads, therefore, your work

will not be overwritten when you

update your data. Save each

of your own .xls spreadsheets with

its own unique name (usually just

the symbol) in the same directory

that you download the .csv datafiles.

The supplied .xls spreadsheet may

be used as a template for all your

"working" spreadsheets (save

this downloaded spreadsheet in the

same directory that contains your

downloaded .csv files.

|

|

Let's try it: |

|

► |

We will assume

that you have already set up the

MasterDATAlink program and downloaded

daily data setting either

eSignal or Reuters as your data

vendor in your download list settings.

It is also assumed that Microsoft

Excel is installed on your computer.

|

|

|

|

► |

One of the

datafiles downloaded should be the

Dow Jones

Industrial Average daily

data. The eSignal symbol for

this index is

$INDU.

The Reuters symbol is

.DJI.

For purposes of this illustration,

we shall use the Reuters symbol,

.DJI. The "Demo" MasterDATAlink

downloads this datafile also.

So we are all on the same page. |

|

|

|

► |

Download the Spreadsheet

Template from the MasterDATACSV.com

web site by clicking on the following

link |

| |

|

| |

Download Spreadsheet

Templatee

(for Reuters symbol _DJI.csv

datafile) |

| |

|

► |

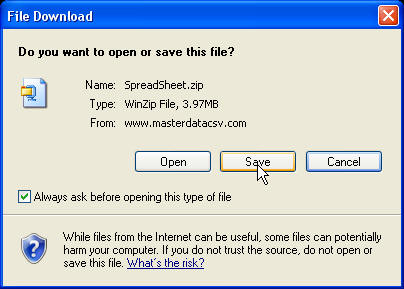

In the dialog that appears,

click on "Save"

|

|

| |

|

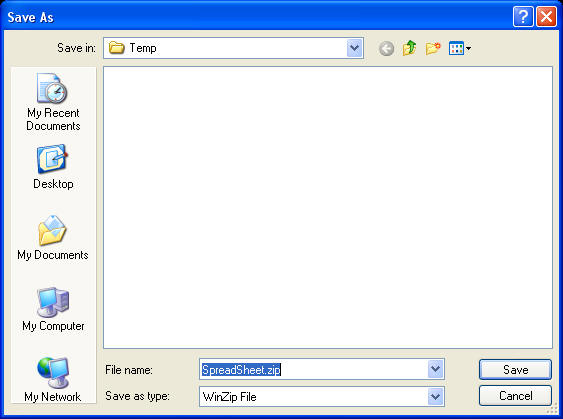

► |

In the next dialog

window that appears ("Save as"),

for this example, create a new folder

called "Temp"

in your "My

Documents" folder.

In actual practice,

you will want this Excel spreadsheet

residing in the same directory as

your downloaded .csv datafiles.

|

|

|

|

|

► |

Make sure you are in your new

"Temp" directory.

Click on "Save".

|

|

|

|

|

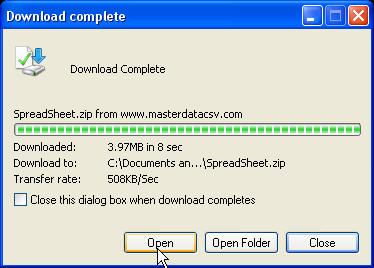

► |

In a few seconds, the "Download

Complete" dialog will

appear.

Click on "Open".

|

|

|

|

|

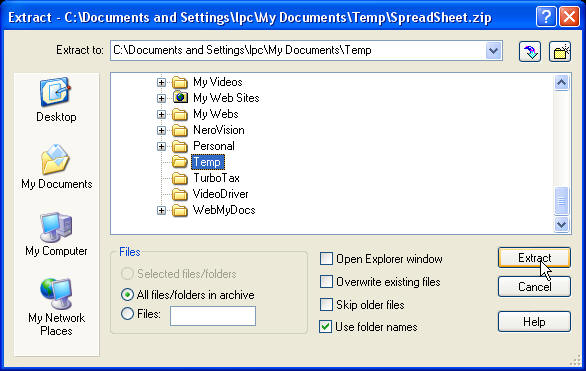

► |

Assuming you are using

WinZip,

this dialog window will appear:

Click on "Extract".

|

|

|

|

|

► |

Browse to the

new "Temp"

folder in your "My

Documents".

Click on "Extract".

|

|

|

|

|

► |

Close the WinZip

program window.

|

|

|

|

► |

Using Windows

Explorer, go to the "C:\Documents

and Settings\xxx\My Documents\Temp"

directory (where "xxx" is your username):

First open the

file "_DJI.csv".

Once that file is open, then open

the file "_DJI.xls".

It is important to open the files

in this order (.csv first, then

.xls).

|

|

|

|

|

► |

You should now

have two files opened in Microsoft

Excel, "_DJI.csv"

and "_DJI.xls".

The values displayed in the .xls

file are simply the values it is

reading from your downloaded "_DJI.csv"

file. Every time you download

in the future the Excel .xls file

will reflect the new values of composite

breadth data it reads from the newly

updated or downloaded .csv

file (assuming you always download

to the same directory containing

your .xls spreadsheet).

|

|

|

|

► |

Well, that is

almost true. There is one

more important step that must be

performed in the .xls spreadsheet

file to allow it to properly display

subsequent days of new composite

data. Since your .xls file

is already open, switch to that

file and go to the bottom row of

the spreadsheet (a fast way to get

there is to click somewhere in the

spreadsheet, then while holding

down the "ctrl" key, press the down

arrow key).

|

|

|

|

► |

For purposes

of this tutorial, we have purposely

omitted one row from the bottom

of the .xls spreadsheet. We

are now going to add a new row so

that all of the data contained in

the .csv file will display properly.

|

|

|

|

► |

In the bottom

row of the opened spreadsheet, click

in the column "A" cell. While

holding down both the "Shift"

and "Ctrl"

keys, press the right arrow key.

The entire bottom row of the spreadsheet

should now be highlighted.

|

|

|

|

► |

While holding

down the "Ctrl"

key press the "c"

key (this copies whatever is highlighted

to the clipboard).

|

|

|

|

► |

Now, press the

down arrow key one time making sure

that the cell highlighted is one

row below the last spreadsheet row

and in column "A". Then press

the "Enter" key.

|

|

|

|

► |

You have added

a new line (row) of code to the

bottom of your .xls spreadsheet

that will display the data in the

related row of data in the .csv

datafile. As new days of data

are added to the .csv datafile in

the future, similar to the above,

add more rows to the .xls spreadsheet

to properly display that data.

|

|

|

|

► |

Save your updated spreadsheet (hold

down the "Ctrl"

key and then press the "s"

key).

|

|

|

You can easily "clone" your

.xls spreadsheet to display data

and create

"working" spreadsheets

for all the indexes and ETFs you

download.

|

|

|

|

► |

First, make a

copy of the original .xls spreadsheet

and name it something recognizable

(we use the index or ETF symbol).

For this example lets use "SPY".

So you should now have a newly copied

spreadsheet named "SPY.xls".

|

|

|

|

► |

Using Windows

Explorer, locate and open the file

"SPY.csv"

in your "C:\MasterDATA\CSV\Daily\"

directory. Now open the new

"SPY.xls"

spreadsheet.

|

|

|

|

► |

A Microsoft Excel

dialog will appear. Click

on "Don't

Update". We want our

newly created spreadsheet to link

to the "SPY.csv"

datafile, not "_DJI.csv",

so we need to make some changes

first before worrying about updating

the new spreadsheet.

|

|

|

|

► |

In addition to

anything else you may have opened,

you should also now have open "SPY.xls"

and "SPY.csv".

We are now going to link them up.

|

|

|

|

► |

Switch to the open spreadsheet,

"SPY.xls"

and click on cell "A1"

(top left corner). |

|

|

|

► |

Press the "F2"

key (function key not two letters).

This will allow you to see the underlying

formula of the cell. Identify

the symbol that was utilized in

the prior spreadsheet formulas.

In this case the symbol is "_DJI".

So we now know we need to replace

this symbol with the new symbol

"SPY".

Press the "Esc" key.

|

|

► |

Now, while holding

down the "Ctrl"

key press the "h"

key (this activates the find and

replace Excel function within the

spreadsheet). In this example,

enter "_DJI"

in the "Find

What" text box and "SPY"

in the "Replace

With" text box. Click

on the "Replace

All" button. In a few

seconds all the .xls links have

been modified to point to the downloaded

"SPY.csv"

datafile .

|

|

► |

Save your new "SPY.xls"

spreadsheet. |

Work in

your Excel .xls spreadsheets,

not in the downloaded .csv datafiles.

Your calculations will thereby be

preserved and applied to subsequent

new data as it occurs. The

downloaded .csv datafiles contain

the historical composite data.

The .xls spreadsheet contains and

protects your work. Don't

forget to back it up regularly.

|